In recent blog posts, I’ve been discussing the drivers behind hyperscale data centers – how smartphones and multi-media content as well as the emergence of big data and the IoT have pushed workloads to the brink. These factors have created the need for unprecedented scale and resource density and led to hundreds of hyperscale facilities appearing across the planet.

Then there’s the new trend for edge data centers, which are popping up in huge numbers and in a variety of guises. As operators look to reduce cost and latency by harnessing local compute and storage for a new generation of services, this type of distributed cloud computing is set to grow significantly in the next few years.

Clouds in the central office

But what does all this mean for network operators? For telcos, the central office is where they connect with their enterprise and wholesale customers. The way for carriers to apply hyperscale architecture is through an initiative known as central office re-architected as a data center (CORD). CORD aims to give service providers data center economies and enables them to offer services to residential, mobile and enterprise customers with the agility of the cloud.

This approach adopts hyperscale architecture and combines network functions virtualization (NFV) and software defined networking (SDN). AT&T are at the forefront of this drive with other major telecommunications companies also looking to deliver services from a platform built on COTS servers, top-of-the-rack switches and a spine switch architecture.

Of course, this opens further revenue streams as surplus capacity can be used for additional value-added services at the edge or rented to others. Carriers find themselves in an ideal position to make the most of this new opportunity as they already have so many facilities close to where data needs to be compiled. Time-critical applications like augmented reality and self-driving cars will depend on this close proximity.

Connecting the cloud

For us at ADVA, the focus is always on connectivity, and we’ve seen great changes in the networking environment over recent years. What began as a component of simple disaster recovery and business continuity has become a multi-tier architecture with a huge range of different needs.

Data center interconnect (DCI) has had to change too. For operators of data hosting and colocation facilities, it’s no longer all about space and power. Connectivity is now also a key strategic asset and, for many applications, good performance in terms of latency and security can be crucial. For others, capacity is the pivotal factor. Increasingly, agility is also needed to react to shifting demand. DCI is now about creating solutions to cater for specific requirements.

Although simple point-to-point models still exist, there are now a range of technologies and topologies to complement them. There are also more protocols to contend with; as well as the traditional role of Fibre Channel being used for storage, we now have Ethernet, IP, point-to-point and multi-point, creating a variety of environments. The range of operating environments has diversified also to include self-provided and managed services, as well as dedicated and multi-tenant installations.

New cloud opportunities

Recently, cloud service providers have begun to demand connectivity that suits the applications they provide. Cloud services are synonymous with agility, reliability and responsiveness. In contrast, connectivity has always been a static model, and so cloud providers are looking for something more elastic. They may only need connectivity for a couple of hours at a time and so SDN-based provision that can be shared with other users can provide much more value.

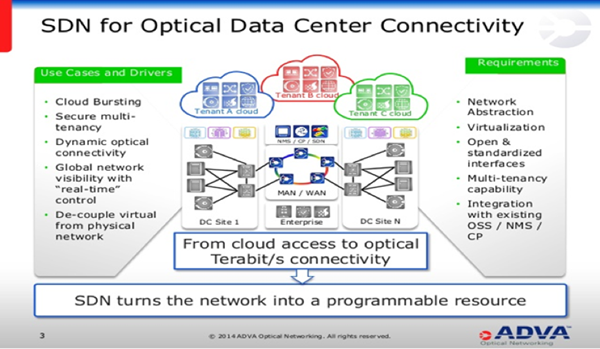

Here’s a slide we put together four years ago at the beginning of the SDN era for a proof of concept we conducted with IBM and Marist University. At that time, we demonstrated an SDN-based optical network controlled by cloud applications. It’s this model of programmable resources that can be shared across users that is being widely demanded now:

This model presents an opportunity for network operators to come up with new service ideas. It also changes the model of providing services and applications for residential, business and wholesale customers. Now it’s far more diverse, with hosters, colocation facilities and cloud service providers all looking for connectivity that offers more than the traditional static pipe.

It also gives scope for new businesses and business models focusing on cloud companies and industries with cloud-native demands, providing modern tariff-based pricing to this new customer class and forming the basis for a large variety of new, cloud-native connectivity options.

Forecasting clouds

So what will the future look like? As we head into the New Year, it seems appropriate to make a few predictions.

Firstly, I believe all connectivity will be DCI in three years’ time. As everything gets migrated into data center-like architectures, this is really a self-fulfilling prophesy. It means that the DCI business will eventually be one and the same as the optical industry.

Secondly, capacity growth will continue unabated. Unlike some, I don’t see the increase in bandwidth demand slowing any time soon. The current growth rate is about 40 to 50% per year, and I would expect that to be maintained. Links will continue to expand with today’s focus on 100Gbit/s, 400Gbit/s and Terabits soon becoming 40 or 50Tbit/s on a single fiber pair.

Thirdly, there will still be the need for lower capacities in the Gigabit range. In fact, in the coming years, this will probably be even more in demand than today. Sharing will be key here and fat pipes with fine granularity will be the way these services are delivered.

Finally, I expect to see a lot of cloud-native connectivity going forward. By using NFV and SDN to create agility and flexibility in the network, operators will offer bandwidth on demand to their cloud customers to meet the changing needs of tomorrow’s applications.