Fixed wireless access (FWA) is experiencing a resurgence, as a growing number of operators in all regions of the world are leveraging their investments in mobile infrastructure (particularly 4G LTE and forthcoming 5G) to provide fixed broadband services.

Why the resurgence? If one can recall, there have been two major industry attempts at this space. The first was wireless local loop (think LMDS from the late 1990s), but equipment was expensive and proprietary. The other major attempt was WiMAX, which never gained the promised market momentum or capabilities and was quickly overshadowed by a rapidly advancing mobile market with the introduction of LTE.

But enough about the past …

What’s changed in the world of FWA?

- Technology. Advancements in silicon and improvements in antenna design, wavelength propagation, and beam steering/forming/tracking are all contributing to a lower cost base, resulting in a more attractive return on investment. But perhaps more importantly, this is spawning a number of new companies offering innovative solutions to this market.

- Demand. Growing demand for faster and faster speeds as well as the ability to cost-effectively provide connectivity to unserved and underserved markets (often paid for by government digital divide funding) creates a ripe environment for investment and innovation.

- Cost. Technology and demand are helping to make the business case a lot more attractive to operators. Wireless local loop was introduced when most people were still using dial-up, while WiMAX had to compete with emerging 3G/4G mobile. Both technologies were hampered by lack of scale, resulting in high equipment costs. Depending on the technology path chosen by FWA operators, the cost to deploy is significantly lower than ultra-broadband solutions, which require fiber deployment deep into the network. Furthermore, many operators offering fixed LTE are able to leverage their existing LTE network for deployments, further reducing costs.

- Competition. Nothing like some competition to propel market development. Just look at the impact Google Fiber had on the FTTH market. Without them, operators would still be deploying DSL. For FWA, not only are there a number of new operators entering the market, but we are also seeing incumbent operators use FWA as a means to offer service outside of their fixed broadband markets – creating a bit of a Wild West environment for customer acquisition.

Leveraging the LTE networks

Millimeter wave has garnered a lot of attention as a fixed wireless technology due to the high speeds it can provide. However, if we were to look at FWA from a subscriber perspective, fixed LTE services lead the pack. Fixed LTE services have provided operators with the opportunity to fill the gap in markets where other fixed broadband services are either not available or are of poor quality and speed.

But … it’s not so simple as to just place an antenna at the customer location.

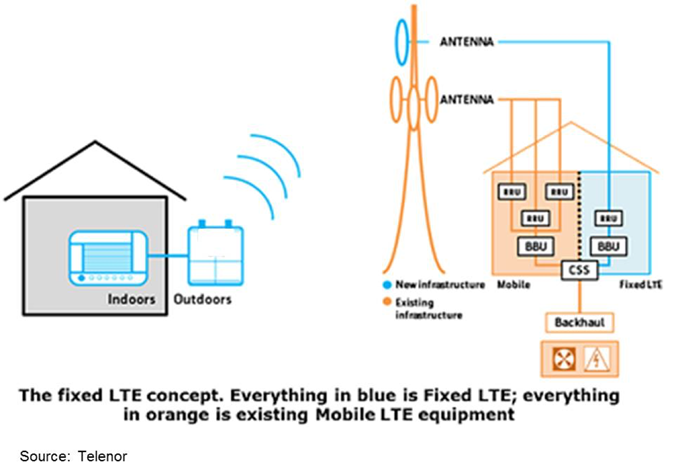

For FWA, mobile operators are able to leverage their existing towers, buildings, power, and backhaul network used for their mobile 4G services. In this scenario, the operator will install base station antennas and radio equipment that is dedicated to its fixed LTE services. But for successful FWA deployment, operators must dedicate spectrum specifically for fixed LTE services.

In this scenario, they will place dedicated fixed LTE antennas in locations approximately 1-5km from the customer and will require line-of-sight. As such, trees, buildings, terrain, foliage and weather can all affect both availability and quality of the service.

FWA speeds

Available speeds for FWA services will vary based on the technology used, spectrum available/utilized, distance to the customer and number of subscribers supported per base station/antenna. In more rural areas, speeds of 5Mbit/s to 10Mbit/s appear to be the average – especially in markets current unserved by any other technology.

In more competitive markets, speeds are significantly higher. mmWave speeds are expected to reach up to 1Gbit/s, while other solutions are typically offering speeds of 50-200Mbit/ss.

In all cases, and unlike mobile broadband, FWA services are often not throttled or capped, making them suitable for streaming video and other applications.

Perhaps the time is finally right for FWA

Similar to any broadband roll-out: Just because you can, doesn’t always mean you should. There needs to be a business case that makes sense. Operators entering this market – whether new or existing – must be sure they can offer the right speed at the right price point in order to acquire enough customers to make the service profitable.

Nonetheless, FWA could help to cost effectively “fill the gap” left when other fixed broadband prove to be too costly or insufficient, particularly in rural markets where the only alternative is often satellite.

And if you’re still not convinced that FWA might have some feet under it this time around, check out Microsoft’s Rural Airband Project announced last year. Microsoft stated it would invest an unspecified amount of money with existing rural broadband carriers to bring broadband to 2 million people in rural America by 2022 with 80% using FWA.

Finally, let’s not overlook the fact that the initial use cases of 5G are fixed broadband. Next-generation FWA is indeed here to stay.