It is in the context of this competitive environment that we explore the five reasons why the Central Office (or Exchange) will be the home of the new telco cloud. So, let’s look at these reasons.

Five Reasons Why the Central Office Will House the New Telco Cloud

1. CSPs are Facing Growing Revenue Pressure From Cloud / OTT Provider

It is no secret that the use of cloud-based business applications and next generation Over-the-top (OTT) services are driving up traffic on the network. The CSPs will tell you that the cost of operating the network is outpacing their ability to recognize revenue from the basic connectivity services.Statistics indicate that the combination of Netflix and YouTube traffic constitutes nearly 50% of all internet traffic in the US[1]. But not a single CSP makes any money directly from the videos or advertising that originate with these OTT providers.

While the cloud and OTT are relatively new service models, we have seen signs that the CSP’s traditional connectivity business model is also under siege. The best example of this phenomenon is the recent win by Google over AT&T for services at over 7,000 Starbucks coffee shops in the U.S[2]. That must have been a shot that reverberated throughout the halls of the world’s traditional service providers.

2. Enterprises Don’t Currently Want to Buy Their Cloud Services From Telcos

In search of new revenue streams to counter the challenges, the traditional telecom operators have responded by getting into the cloud game themselves. Orange, Deutsche Telecom and others have created their cloud service offerings organically. Verizon and CenturyLink have done so through acquisition of Terremark and Savvis, respectively. Countless others have followed suit. Nearly all major CSPs are now offering cloud services[3] and in fact, there were 300 cloud service launches by telcos in 2012[4].

While according to a recent study from Informa, small and medium-sized enterprises are the number one target for communications service providers[5]. But “only 11 percent of SMBs [report that] their preference was for buying cloud services from the same company that currently provides voice and Internet.”[6]

3. Cloud Technology and NFV Provides the Opportunity for Differentiation

The real CSP opportunity comes from leveraging the benefits of the cloud, specifically cloud technologies’ flexible on-demand compute and storage resources, for managed network services using network functions virtualization (NFV). And the good news is that existing cloud technology is ready for NFV with the addition of only a few missing pieces. Industry initiatives such as CloudNFV are rapidly filling in the gaps[7].

By orchestrating cloud and traditional WAN resources like Carrier Ethernet access systems, the CSP can create a platform that offers a fast path to new features and services and provides agility, resiliency and scalability. Bringing the cloud technologies into the network helps CSPs create an application-aware network and new network-aware applications that can effectively protect and grow revenue while staving off the competitive threat posed by the cloud specialist and OTT providers.

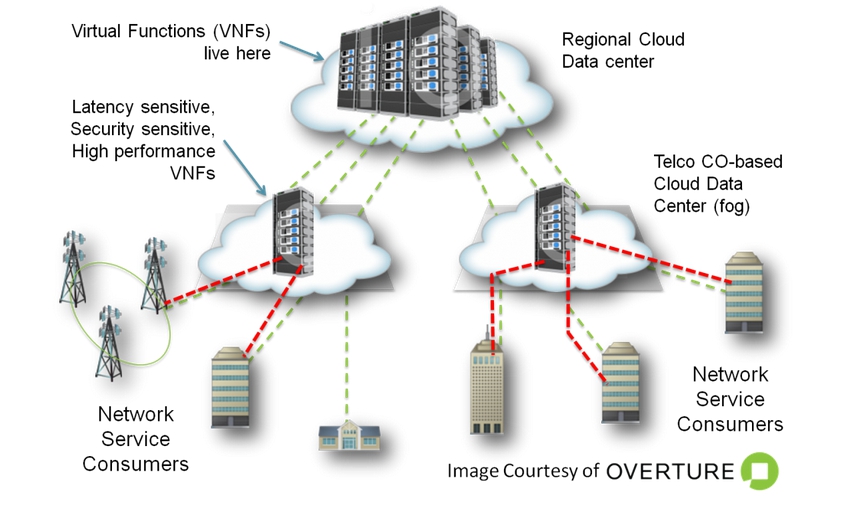

4. Latency, Performance and Security Drives NFV to the Edge

According to Infonetics Research, the top 5 NFV use cases are content delivery networks, IP multimedia systems, virtual managed security, mobile core and firewall[8]. These each have latency, scalability or security concerns that would seem to require their placement as close as possible to the end customer location.

These use cases only begin to scratch the surface of what is possible with a dynamic pool of resources and the automation that comes with modern programmatic interfaces. But with “nearly all profitable Internet traffic transits less than 40 miles,” according to CIMI’s Tom Nolle[9], the focus of value-added network functions will likely continue to be on the metro edge – that intersection between the end customer’s network and that of the CSP.

5. The Answer is Local – NFV Cloud in the Central Office

As with any new CSP technology, there will be a cautious roll out of NFV. It has already begun with deployments in regional datacenters and is migrating to the metro.

[1] http://www.iptv-news.com/2013/05/youtube-netflix-suck-up-half-of-internet-traffic/

[2] http://www.forbes.com/sites/kellyclay/2013/07/31/starbucks-replaces-att-with-google-as-wifi-provider/

[3] http://www.adlittle.com/downloads/tx_adlreports/2013_TIME_Report_Cloud_from_Telcos.pdf

[4] http://www.informatandm.com/white-papers-download-navigating-the-telecom-cloud-%E2%80%93-growth-perspectives/

[5] http://www.informatandm.com/white-papers-download-navigating-the-telecom-cloud-%E2%80%93-growth-perspectives/

[6] http://www.lightreading.com/services-apps/cloud-services/telcos-have-no-cloud-appeal-for-smbs/d/d-id/703300

[7] http://www.lightreading.com/carrier-sdn/nfv-%28network-functions-virtualization%29/new-group-ties-nfv-to-the-cloud/d/d-id/703386

[8] http://www.infonetics.com/pr/2013/SDN-and-NFV-Survey-Highlights.asp

[9] http://blog.cimicorp.com/?p=1211