By the end of 2018, fixed broadband is expected to reach a major milestone – one billion served – supporting nearly 50 percent of total households around the globe. While this number pales in comparison to mobile broadband at nearly six billion subscribers (per Ericsson Mobility Report – November 2018) its significance cannot be overlooked.

This number represents a billion opportunities for service providers and application developers to extract additional revenue streams while offering consumers more value, more speed and more services.

Just take a look at Netflix, Google, Amazon, etc. That fixed broadband connection, probably connecting to a Wi-Fi network and supporting a wide range of personal assistant devices has likely made our lives immensely more entertaining, and in some cases more productive.

In virtually every part of the world, access to broadband is rapidly becoming a necessity similar to electricity and water. In addition, broadband connectivity has become a foundational component in the development and implementation of “smart infrastructure” in support of smart cities, autonomous driving, the internet of things (IoT), digital health and other smart solutions that hope to enhance and improve how we work, live and play.

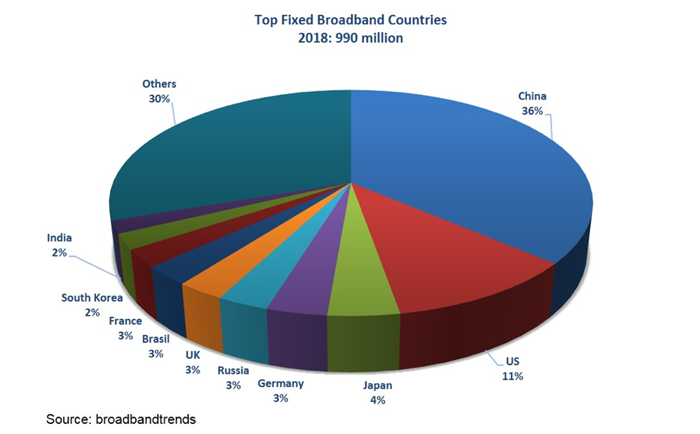

And while fixed broadband growth has been robust, the bulk of the growth can be attributed to China. Through its multiple government initiatives, which have helped fund broadband deployment, China now represents approximately 36% of global broadband subscribers and 65% of global fiber-to-the-home subscribers. To put this in perspective – in the past ten years its fixed broadband subscriber base has grown from 85 million to nearly 370 million – four times the rate of the rest of the world combined.

The need for speed – a gigabit future

After a very long and winding road, broadband operators (and telcos in particular) have finally begun to embrace the benefits of FTTH technologies for their network. The continuing, unabated growth of bandwidth – driven by an ever-growing number of connected devices and their associated applications – has made future bandwidth projections challenging. As such, operators have finally resolved themselves to the fact that it is both a competitive and operational imperative to implement network migration strategies that position their business for the future.

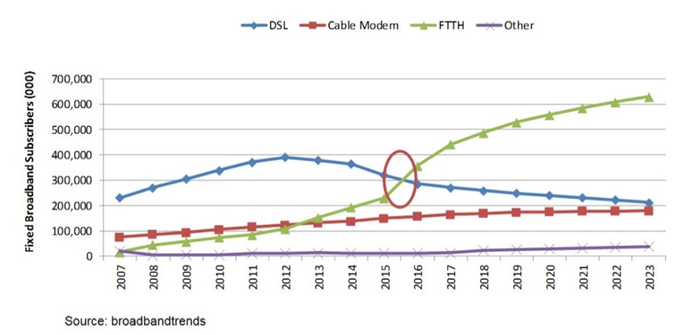

Although, the DSL remains the most prevalent fixed broadband technology for the majority of the world, its importance is waning, as demand has declined year-over-year for the past five years.

Fixed broadband subscribers by type

After years of pushing off investments in FTTH technologies in favor of copper-based ultra-broadband solutions, operators are finally realizing the opportunities that a FTTH network might present to the future of their business. In fact, in a handful of countries including Japan, China, Spain, Portugal, Russian Sweden, Finland, to name a few, FTTH has become the dominant fixed broadband technology.

Beyond simply faster bandwidth, which is certainly a key driver, a FTTH network provides operators the ability to offer more speeds and services – particularly symmetric service offerings. This provides a competitive differentiator to operators in an increasingly competitive market.

Operators are also quickly realizing that higher bandwidths and symmetric services can open the door to an expanded addressable market, enabling operators to offer solutions to business and large enterprises that require these bandwidths for applications such as high-capacity data transfer, managed services, cloud-based back-up and storage, LAN/WAN services, telepresence and remote IT, to name only a few. Additionally, these services combined with service-level agreements and often multi-year contracts provide a generous source of recurring revenue that provides an attractive return on investment and lessens cost concerns. Finally, with the imminent arrival of 5G mobile services, a fiber network can be used for both mobile backhaul and fronthaul, as well as the aggregation of remote access node traffic.

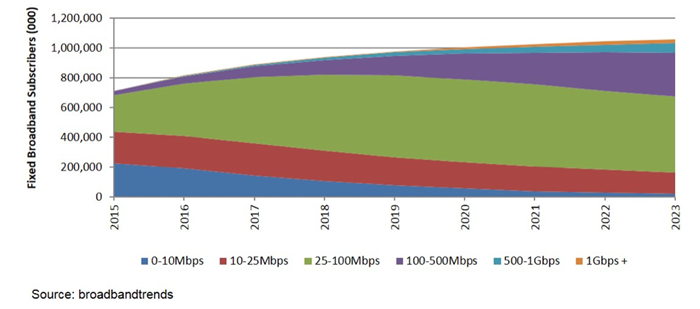

Despite the fact that operators are positioning their networks in support of gigabit services, there has not been a rush to offer consumers gigabit speeds. Given current speed trends, it is expected that a large majority of speeds will remain in the 100Mbit/s range. However, we will start to see strong growth in the 500Mbit/s-1Gbit/s segment as competition from 5G services begins.

Fixed broadband subscribers by speed

The mobile threat looms

The biggest threat to fixed broadband remains mobile. Historically, mobile broadband could not support either the same quality of service or the sustained throughput as fixed services. More importantly, since most fixed broadband plans offer virtually unlimited bandwidth usage – it is typically more cost friendly to utilize a fixed connection for streaming video and other higher bandwidth services and applications.

However, 5G has the potential to disrupt a large portion of the fixed broadband market with its promise of super-fast speeds and super low latency, making it suitable for a wide range of applications and services. It is safe to say, though, that it will take a significant period of time before 5G fully lives up to its promises.

What’s next?

It took 10 years to reach 500 million and another eight years to reach one billion. Logic would say that by 2025, that number should near 1.5 billion. However, penetration in the largest market, China, is nearing 80% and, as such, growth is expected to slow. Other markets such as India have failed to live up to their fixed broadband expectations. However, as operators such as Reliance Jio invest in the fixed broadband infrastructure with FTTH, the potential to reach the next milestone in fixed broadband subscribers is possible … but probably not until 2030.

Fiber is the future of fixed broadband and the key to sustaining growth in both new subscribers and new revenue opportunities.